Business Owner Returns & Valuation

A short article on valuation math

“Investing is most intelligent when it is most businesslike.” - Benjamin Graham

The math discussed below is not original but hopefully the connection to valuation math provides a slightly different lens to think about this concept.

Part 1: Business Owner Returns

The return on any investment is the function of three factors: (1) price paid per share, (2) dividends paid to the owner during ownership, and (3) sale price per share.

Many public equity value investors think thru investment return math as, “ABC is trading at 8x today and has historically traded at 15-20x. The business will be able to correct ‘current issue X’ and once the clouds clear, ABC will trade back up in the normal P/E range.” While there is nothing necessarily wrong with that approach, it does rely on the market agreeing with you on a future valuation multiple.

There is a simpler approach - what I call “business owner returns”. Effectively it says (1) given the current market valuation, what rate of return do I get on returned capital, plus (2) how much in value growth should the asset experience due to distributable cash growth.

Distributable Cash Yield (in dividends + share repurchases)

+ Growth in Distributable Cash Yield

(=) Business Owner Return

In simpler words, it can be thought of as dividend yield + EPS growth, while assuming no change in the P/E valuation.

If a company chooses to distribute 100% of their earnings to shareholders, then the return equals the dividend yield (unless it is a special company that can growth without reinvestment, like a royalty company). And vice versa, if a company chooses to reinvest 100% of their earnings, then the business owner’s return will be equal to their earnings growth. And, to add one complicating factor, that growth will equal the return achieved on that incremental equity invested.

Of course, the ultimate return includes the change in valuation from investment to sale. However, if you can buy into a business at a very attractive “business owner return”, any increase in the valuation is just an added extra.

“This is the cornerstone of our investment philosophy: Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good results.”

- 1962 Letter to Buffett Partnership Investors

Part 2: Connection to Valuation

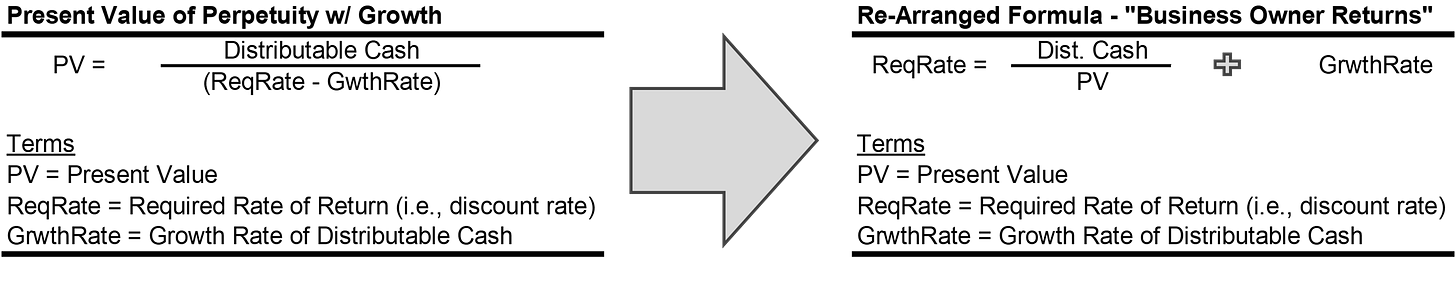

”Business Owner Returns” are really just a re-arrangement of the Perpetuity Growth Formula - a core concept in valuation math.

Again, the focus is no longer necessarily on what an asset is worth (i.e., a P/E approach) but instead looking at what the market is “giving you” in terms of implied future returns.

Viewing an asset this way should solidify what is really important:

Is current distributable cash expected to continue (i.e., durable?)

What is the return on future equity invested?

What % of future distributable cash will be paid to investors vs. retained at the above estimated rate of return (i.e., #2 * #3 create growth as shown below)

And it should come as no surprise that the most important factor in determining #1 and #2 above is the competitive advantages of that business/industry - a determination requiring more than just math. As the Ben Graham quote states, “Investing is most intelligent when it is most businesslike.”