FFD Financial (FFDF) - 4Q23 Update

Small, high-quality bank available at very attractive valuation

Summary

I wrote-up FFD Financial (OTC-listed: FFDF), the bank holding company of First Federal Community Bank, in early November 2022.

A very brief summary: FFDF is (1) a cost efficient bank with (2) a long track record of very low loan losses, (3) a dominance in their local markets, and (4) trades/traded at a low valuation. At the time FFDF’s stock price was ~$33/share; it now trades at ~$29/share (current market cap = ~$87mm).

Despite the decline in stock price, the value has likely increased mainly attributable to the increase in core deposits. Due to this, I think a 25%+ IRR is currently possible with FFDF over the next five years. I encourage reading of the previous write-up before reading this update.

Core Deposit Growth

Core deposits for a bank are supposed to represent the “stickiest” customer deposits. The definition typically removes large deposits over the $250k FDIC limit and other deposits obtained via a broker or listing service.

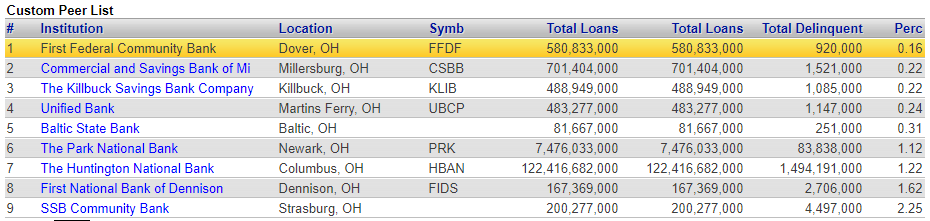

Following the deposit run and subsequent failure of Silicon Valley Bank and a few others, deposits shifted drastically for many banks. Large movements quarter-to-quarter are rare. The bank failures of 2023 provided interesting insight into where consumers trust their deposits. Many of the largest banks benefitted as people viewed them as a source of strength. But certain community banks benefitted too with FFDF one of these winners. FFDF ranked in the top 10% of all Ohio banks for growth in core deposits in 2023 and #2 among its direct peers (see below).

Even more interesting, core deposits increased ~4% in 1Q23, the quarter Silicon Valley Bank failed. While a 4% change in a quarter might not sound like much, that equates to 16% annualized. Compare that to the average year for banks where deposits increase 4-5% per year.

Net Interest Income Growth

The additional deposits also allowed them to escape much of the collapsing spread that certain banks experienced. Many banks tightened lending standards in 2023, slowing loan growth. Meanwhile, deposit costs continued to creep higher. Due to the lack of loan growth, new higher-yielding loans could not help offset some of the higher deposit costs.

FFDF’s situation was different. With the influx of extra deposits, FFDF was able to invest the deposits at high rates, either via lending or simply in cash instruments earning 5%+.

Either way this allowed FFDF’s earnings to increase in a year when many banks saw their earnings remain flat or decline. FFDF’s one-year net income growth ranked in the top 20% for all Ohio banks and #2 among their direct peers.

Conservative Loan Portfolio & High PPNR

Outside of the benefits of extra deposits, FFDF continues to be a well-run, conservative bank ending the year with the best loan delinquency metrics among its closest peers. Loan focus continues to be on 1-4 family mortgages and owner-occupied CRE (meaning, not investor owned CRE) - these categories are traditionally lower risk.

FFDF also is the leader, among direct peers, in pre-tax, pre-provision income (“PPNR”) as a percent of assets. PPNR can be thought of as the first line of defense against loan losses. Before a loan loss impacts capital, it will first be absorbed by income - specifically, PPNR income. Only once PPNR is fully exhausted by losses, is capital impacted. I wrote about this in more detail in the November 2022 write-up of FFDF.

With a strong ~1.9%-2.0% PPNR/assets, FFDF could incur ~2.5%-2.6% annual loss rate on their loan portfolio (including foregone interest) before reporting an overall net income loss. FFDF’s highest year of loan loss provisioning during the Financial Crisis was ~0.5%. Although every recession is different, it’s just another example of FFDF’s strength - and, shareholders are fortunate to have the same management team running the bank today.

This ability to incur substantial losses, while also being the leader in low loan delinquencies, creates a large safety net for FFDF shareholders.

Valuation

If you think about business owner returns, FFDF currently earns $4+ per share and trades at ~$29 per share, implying a ~14% yield. Of course, management is not simply paying out every dollar as a dividend - so, looking at it that way is a bit irrelevant. However, the non-dividend, retained earnings have historically become worth more than dollar-for-dollar as the business produced a high-teen returns on that invested equity.

A bit of a deeper dive into FFDF’s financials/valuation below:

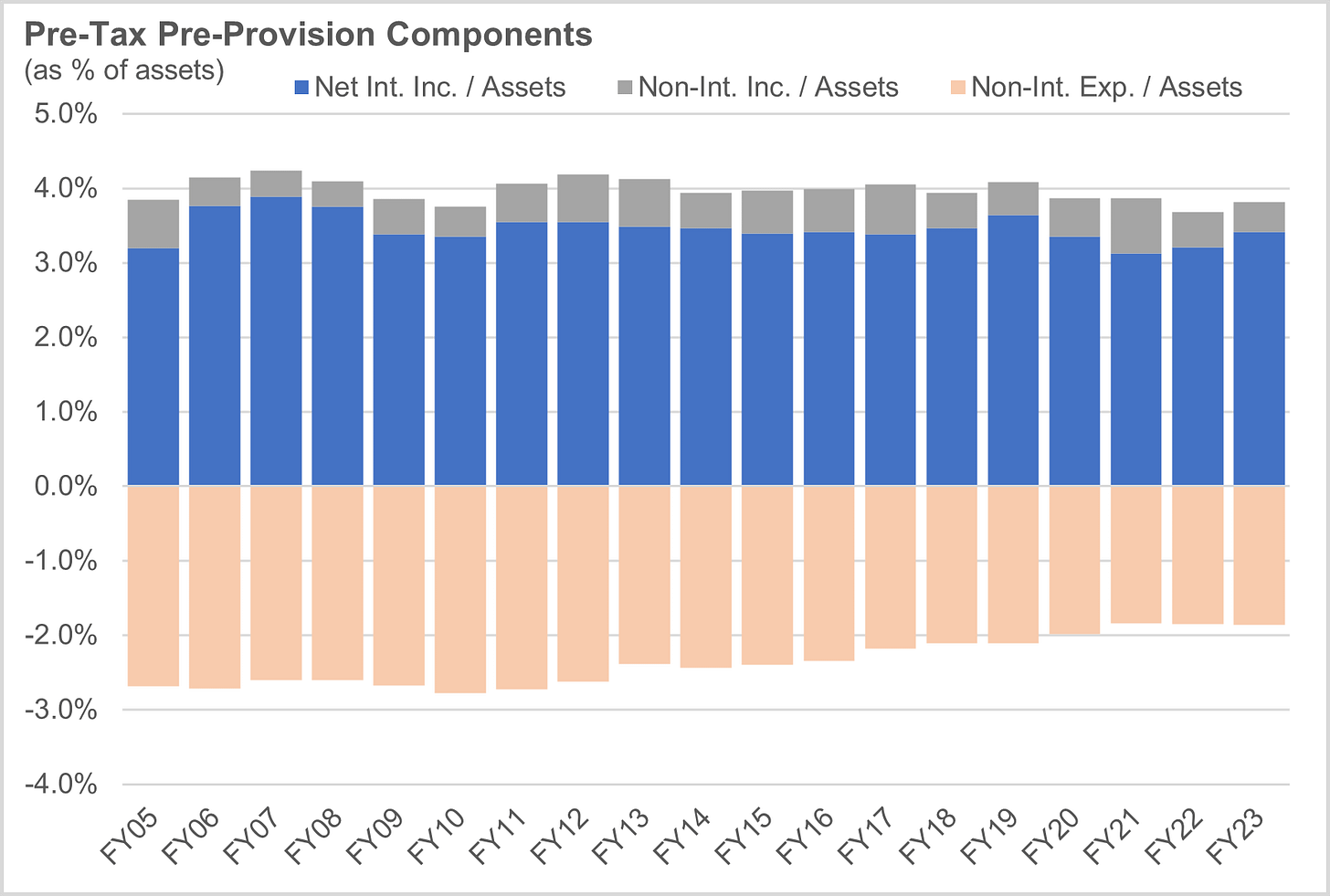

FFDF’s PPNR/assets has increased over the past 10 years as each branch has grown deposits/loans and therefore, provided additional revenue within their existing branch cost structure.

This dynamic pushed down non-interest expense / assets, while the revenue components of PPNR (net interest margin + non-interest income) remained roughly the same as a percent of assets (see below chart).

FFDF has the potential to increase PPNR/assets above 2.0% sustainably, if they can continue to generate deposits within their existing infrastructure. As mentioned in the previous write-up, FFDF does dominates its markets so the extent of growth available in markets where they have 50%+ deposit market share remains to be seen.

However, if FFDF only maintains at ~2.0% PPNR and you assume a 0.2% normalized provision, that implies 1.8% pre-tax income / assets. After a 17-18% tax rate (lower due to non-taxable municipal bond income), that math produces a ~1.5% net income / assets.

While FFDF has historically grown deposits at 8-10%, if only 5-6% growth rate is achieved, they should have roughly $1.0bn in assets in five years. A 1.5% return on $1.0bn in assets is $15mm or $5/share. At 15x earnings, implies $75 per share value. FFDF will also likely produce ~$15 of excess earnings over that period available for dividend. This produces $90 per share in value (inclusive of dividends) in 5 years - a 25%+ IRR on the current $29 stock price.

However, if FFDF manages to grow deposits out of their current branch structure (or opens new branches as they have done successfully in the past), decreasing non-interest expense / assets further, PTPP/assets could be even higher in five years. Running the math under these best-case scenarios produces $115+ per share of total value in five years (inclusive of dividends) - a 30%+ IRR.

Of course, a recession could occur, where loan losses increase for a period. This scenario would mainly reduce excess earnings over the next five years, and have less impact on the ultimate terminal value of FFDF. Even if there is some permanent impact, say, from a sustained lower interest rate environment compressing net interest margin, there is still a large cushion available with such a high return seemingly available at current prices.

Combined with the low risk attributes mentioned earlier, FFDF at current prices presents an interesting potential investment.

Important Reminder: FFDF is a very small bank with a fairly illiquid stock listed on the OTC.

Disclosure: I currently hold shares of FFDF. I may buy more or sell my position at any time. Please do your own due diligence before making any investment. None of my posts are investment advice.

Love the write up! Any updated thoughts following last Q earnings and lower prints on ROA and ROE?

Terrific idea, thanks. Any thoughts on the management team and how you rate them? Corporate governance and the quality of the management team are always of paramount importance, but especially so in banking.