“Henry reminds me of De Gaulle. He has a singleness of purpose, a tenacity that is just overpowering. He gives you absolute confidence in his ability to accomplish whatever he says he is going to do. Yet, he is rather aloof, operating more or less by himself and dreaming up ideas in his corner office.”

- Arthur Rock (Teledyne Board member and early venture capitalist)

After re-reading “Distant Force: A Memoir of the Teledyne Corporation and the Man Who Created It”, I added to and re-organized some notes I had on Teledyne and Henry Singleton - this article is the result of that process. Near the end, I included some financial charts/analysis on Teledyne’s figures over Henry Singleton’s tenure as CEO.

Teledyne History

Pre-Teledyne Background

Henry Singleton was born in a small Texas town in 1916

When Singleton was young he said he desired to found and run a large company like GE or US Steel

As an older Singleton: “He was a student and an observer of the history of manufacturing. He studied the progress and growth of corporations from the days of Henry Ford to GM and how successful corporations grew by acquisitions. He studied the behavior of Jimmy Ling and others who were beginning to grow in this manner. He studied the Littons, the TRWs, the LTVs, the City Investings, the Gulf & Westerns, and today’s largest of all conglomerates, GE.”

(interesting side note) Singleton was extremely talented at chess

100 points below Grand Master level and could play blind-folded

Singleton would later compare managing Teledyne to a competitive game: “Our objective is to increase our rate of earnings faster than [the competitors]. It is a lot of fun. As a result, we visualize it as a competitive game.”

Attended Naval Academy and then MIT, where he earned PhD in electrical engineering

Also worked at the CIA predecessor, the OSS (Office of Strategic Services), during World War II

Graduated in 1950 and joined Howard Hughes company, Hughes Aircraft

Recruited to Hughes by Simon Ramo, who mentioned Singleton was the only student who had achieved 100s in all his classes

Also mentioned how Singleton had “quiet dignity and gentleness and kindly intelligence, with no ego… While the other graduates wanted to deliver prepared recitals of their accomplishments, Henry asked questions…”

Eventually was recruited to the conglomerate Litton Industries in late 1950s

While there he invented inertial guidance system, still used in aircraft today

Became head of Litton’s Electronic Systems Group and grew it to be the company’s largest

Singleton and a colleague from Litton left to found Teledyne in 1960

Initially bought a small electronics company named Amelco

Teledyne became public company in 1961

Goal was to found a business that was a leader in aircraft/aerospace electronic control systems and other technologies needed to support that business

Singleton in 1968, “So we went into [semiconductors] in 1960…We did it because of our conviction that it was necessary for our long-term future growth and not because of any conviction what we would immediately make huge amounts of money. We decided that if we were going to manufacture, develop and sell electronic control systems, we ought to have a capability in the component area. That would enhance our ability to design systems because we’d know more about new components we could use; on the other hand, our expertise in systems would enable us to better judge what kind of components to develop.”

Diversified over time and eventually expanded into specialty metals industry, among others

Singleton said specialty metals expertise was vital to the development of semiconductor components needed for advanced electronic control systems

Also realized that advanced alloys were becoming increasingly important in space / military applications

Focused on profitable, growing companies, with leading market positions, often in niche markets

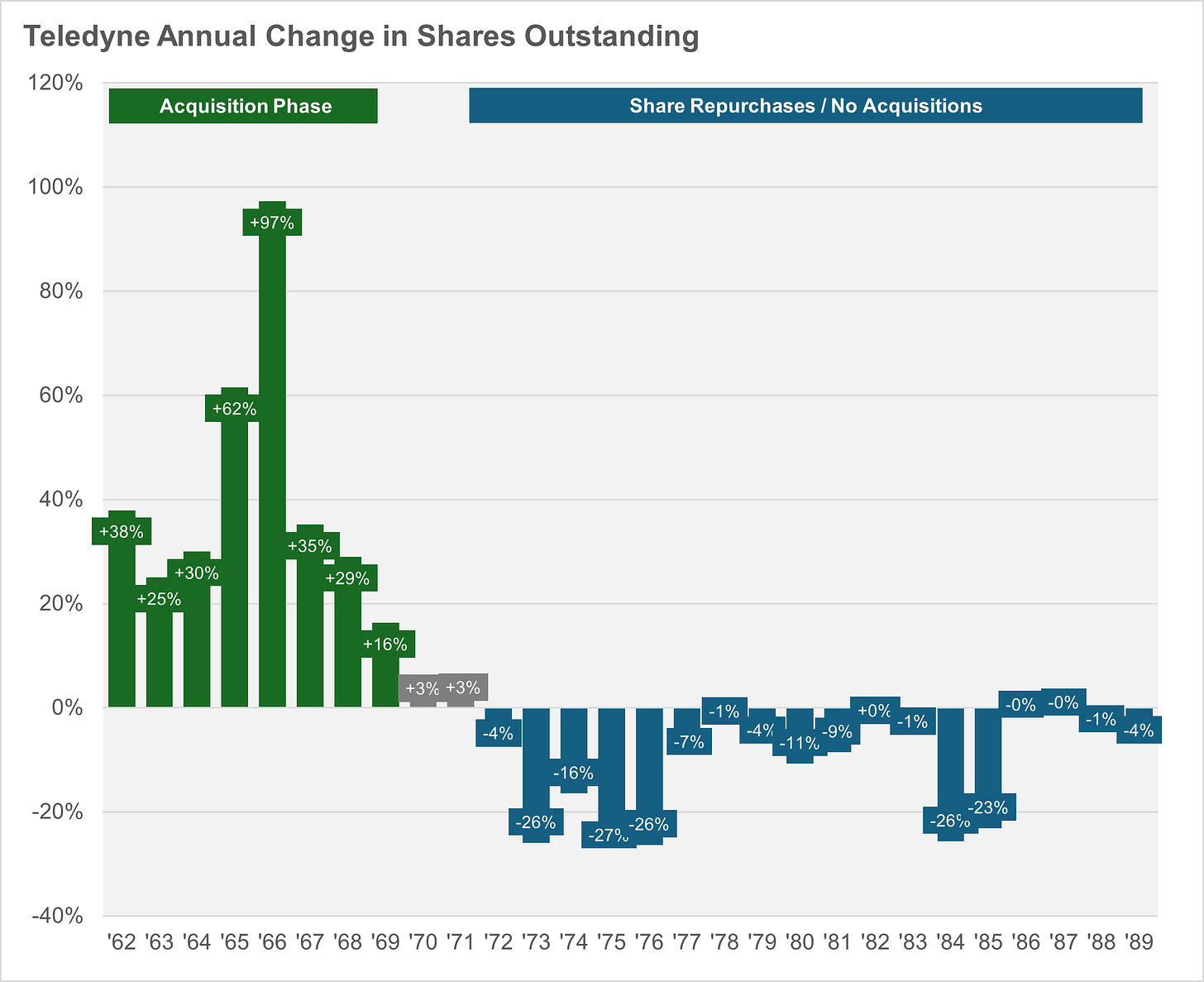

With conglomerates trading at high valuations, between 1961-1969, Teledyne ultimately purchased 130 companies, utilizing Teledyne’s higher P/E to issue Teledyne stock to a target at an acquisition price with much lower P/E (classic P/E arbitrage in M&A)

Despite the highly-valued currency, still paid reasonable valuations, never paying more than 12x P/E - purchasing most significantly <12x

During this period, Teledyne’s P/E ranged from ~20-50x

When asked if he was building another Litton, Singleton responded: “Hell no, I’m trying to create another GE.”

“Henry’s chose of companies to acquire gradually became more and more diverse. At first it was a a matter of choosing those companies that were available at a reasonable price, that were within his means to acquire, that fit, however loosely into his government and military business. Later he would look afield to companies that were less and less related to his original electronics. Government, military markets, but would diversify and contribute to the profitability of his company.”

Diversification into Insurance & Finance

Henry multiple times mentioned a book by the former Chairman of General Motors to Teledyne President, George Roberts

In the early 1920s, General Motors had a failed bond offering and the chairman realized an important lesson about having a strong “financial base”

Due to this, GM started General Motors Acceptance Corporation and invested in other financial institutions

Based on this idea, Henry had previously decided that at some point Teledyne would seek out financial institutions to acquire, with an emphasis on insurance companies

During the end of their acquisition period, in 1968, Teledyne made their first insurance acquisition, buying a stake in Unicoa, a life insurance company

Teledyne stopped acquiring completely in 1969, when (1) Teledyne’s stock began trading lower, (2) acquisition valuations continued to increase, (3) less good companies were available, and (4) thought they could get more money buying less than 100% stakes in companies via the stock market

From that point on, Teledyne never did another acquisition

Began to focus on improving operations, repurchasing shares, and investing the insurance company portfolio

Share repurchases

In 1972, with everything else still expensive, thought Teledyne’s own stock was the best use of capital and so the company began to repurchase shares

Over eight tenders from 1972-1984, repurchased 90% of outstanding shares

Average repurchase was at P/E <8, versus average issuance P/E of >25x during Teledyne’s acquisitive years

Insurance portfolio

Singleton took over the insurance portfolio in mid-1970’s

reallocated the portfolio from 10% equities in 1975 to 77% by 1981

Put 70% in top 5 equity positions, with 25% in top position, which was Litton Industries - Singleton’s former employer

Invested in companies he knew very well - many conglomerates like Litton and Curtiss Wright

In late 1980’s, carried out a series of spin-offs to simplify the company, and began a dividend in 1987

Singleton ultimately retired in 1989

Investment & Operational Philosophies

Value investor with strong understanding of opportunity costs

“I don’t believe all this nonsense about market timing.” Singleton says. “Just buy very good value and when the market is ready that value will be recognized.”

“There are tremendous values in the stock market, but in buying stocks, not entire companies. Buying companies tend to raise the purchase price too high. Don’t be misled by the few shares trading at a low multiple of 6 or 7. If you try to acquire those companies the multiple is more like 12 or 14. And management will say, ‘If you don’t pay it, someone else will.’ And they are right. Someone else does. So, it’s no acquisitions for us while they’re overpriced. I won’t pay 15 times earnings [a ~6.7% earnings yield]. That would mean I’d only be making a return of 6% or 7%. I can do that in T-bills.”

Concentrated portfolio with emphasis on companies that Singleton knew very well

“Currently Singleton has over 50% of his equity portfolio in Conglomerates… All these conglomerates are companies in fields that are related to Teledyne’s own experience.”

“Singleton also has a block of oil stocks with good gains, including Mobil and Standard Oil of Indiana. Teledyne companies are in geological, exploration and make drilling rigs; so again, he has chosen a field he clearly understands.”

[from 1979 Forbes article] “Singleton’s biggest move was to put over $130 million—25% of his equity portfolio–into Litton. Teledyne now holds 27% of Litton…worth $270 million; and is 25% of its insurance company’s equity portfolio.”

“I felt Litton was a sound investment,” Singleton says. “It’s good to buy a large company with fine businesses when the price is beaten down over worry about one problem.” (He refers to Litton’s costly and protracted shipbuilding issues with the U.S. Navy). Singleton added “Litton’s problem was not a general one but an isolated problem—as ours was with Argonaut Insurance. To me it was hard to believe the heads of a $3 billion or $4 billion business would not be able to handle one business problem.”

Focus on Cash

“Our attitude toward cash generation and asset management came out of our own thought process. It is not copied. After we acquired a number of businesses we reflected on aspects of business. Our own conclusion was that the key was cash flow.”

Roberts says: “Net income without cash is not necessarily net income. We build cash generation into the system of paying our managers. Bonuses can be 100% of base salary.”

Singleton: “If anyone wants to follow Teledyne, they should get used to the fact that our quarterly earnings will jiggle. Our accounting is set to maximize cash flow, not reported earnings.”

Mindset of long-run optimism, low-risk and maximum flexibility

Long-run Optimist

[In 1979] “What is Henry Singleton’s own sense of economic reality? At a time when many top businessmen are gloomy about the future of the country, Singleton has this to say: “I’m convinced the coming recession will not be too deep or long and we will have a good recovery following it. It is so fashionable to complain about the restrictive regulatory environment in Washington. That makes people forget how very much worse things could be. Long run, I am happy about the prospects for America, for business and for Teledyne.”

Low-Risk Focus

“Risk, too, is carefully rationed. A coolly rational man, Singleton, despised surprises. It is company policy that divisions which are federal contractors will remain relatively small. “We don’t want any big prime contracts, says [Teledyne President] Roberts. “We prefer to be important, technically oriented subcontractors who serve those who want to be prime contractors.” That way, if a large contract is aborted Teledyne will not be hurt. The effect of all this emphasis on restricting risk and insisting on high return, Roberts says, is that he’s been able to stop preaching. “Now everyone understands that all new projects should return at least 20% on total assets. When leveraged up, return on equity can be 30% to 50%. This is so ingrained that few lower-returning proposals are ever presented anymore. We hardly ever discuss one.”

“Teledyne is like a living plant, with our companies the different branches and each putting out new branches and growing so no one business is too significant.”

Maximize Flexibility

“My only plan is to keep coming to work…I like to steer the boat each day rather than plan ahead way into the future.”

“I know a lot people have very strong and definite plans that they’ve worked on all kinds of things but we’re subject to a tremendous number of outside influences and the vast majority of them cannot be predicted. So my idea is to stay flexible.”

“I believe in maximum flexibility, so I reserve the right to change my position on any subject when the external environment relating to any topic changes, too.” A CEO’s most important job, he goes on, is to anticipate trends and act to help his company.

Independent Thinker

Singleton repurchased shares when doing so was much more rare. Back then, it was considered a sign of weakness - that the company had nothing better to do with the capital than return it via repurchases. Not only did he conduct repurchases, he obviously did them in an extreme size that is rare even today.

“In 1997, two years before his death from brain cancer at age eighty-two, [Singleton] sat down with Leon Cooperman, a longtime Teledyne investor. At the time, a number of Fortune 500 companies had recently announced large share repurchases. When Cooperman asked him about them, Singleton responded presciently, ‘If everyone’s doing them, there must be something wrong with them.’”

“During the 1968-1974 period he considered bonds as high risk and stocks as low risk, contrary to popular opinion…”

Result was the insurance investment portfolio’s shifted towards stocks when stock prices were depressed in the 1970s - a great decision

“… [Singleton] believed investor relations was an inefficient use of time, and simply refused to provide quarterly earnings guidance or appear at industry conferences.”

Decentralized operation with focus on efficiency / high-margins

Decentralization

“[Teledyne management] manage[s] you by numbers,” says [a] former executive... “As long as you are performing, you never hear from them.”

“But the consequences of coming up short can be excruciating. At budget review meetings the craggily handsome Singleton turns “hard, cynical, and cold,: speaking in measured, clipped tones “like he is biting a bullet,” recalls a former associate.”

Day-to-day operations were managed by President, George Roberts, with decision-making responsibility pushed down to lowest-possible level

However, capital allocation decisions were centralized to headquarters

This setup allowed Henry to be mostly involved in big picture strategy and investing the insurance investment portfolios. He figured others could manage the operations better than him, allowing him to focus on the areas where he excelled

Attract High Performers

“We have what is called a “management inventory.” We work our heads off to increase our own capability at collecting and promoting the right people. To the extent we succeed, the whole company will succeed. We increase our bets on the men who seem to be performers.”

Utilized stock options to attract high potential people to Teledyne

Allocate Capital To High Return/Margin Subsidiaries

“Forget products,” [President George] Roberts begins, “Here is the key: We create an attitude toward having high margins. In our system a company can grow rapidly and its manager be rewarded richly for what growth if he has high margins. If he has low margins, it is hard to get capital from Henry and me. So our people look and understand. Having high margins gets to be the thing to do. No one likes to have trouble getting new money.”

Efficient Operations

According to one article, Teledyne allocated approximately 55% less to capital spending and 30% less to R&D spending than competitors

Teledyne Financial Charts & Analysis

“Henry Singleton has the best operating and capital deployment record in American business.” - Warren Buffett in 1980

Below is a high-level overview of Teledyne’s financials throughout Henry Singleton’s tenure as CEO.

**********************************************************************************************

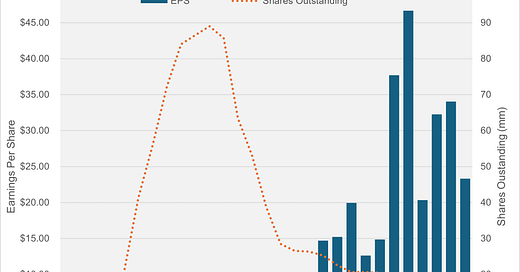

Return on Equity & Leverage - The major item to note is the evolution of the leverage utilized. Once Teledyne’s stock sported a high valuation - in the mid-to-late 1960’s - it was utilized as the main currency to fund much of the acquisition growth. Additional debt was used somewhat during the 1970s share repurchases but was never utilized very aggressively.

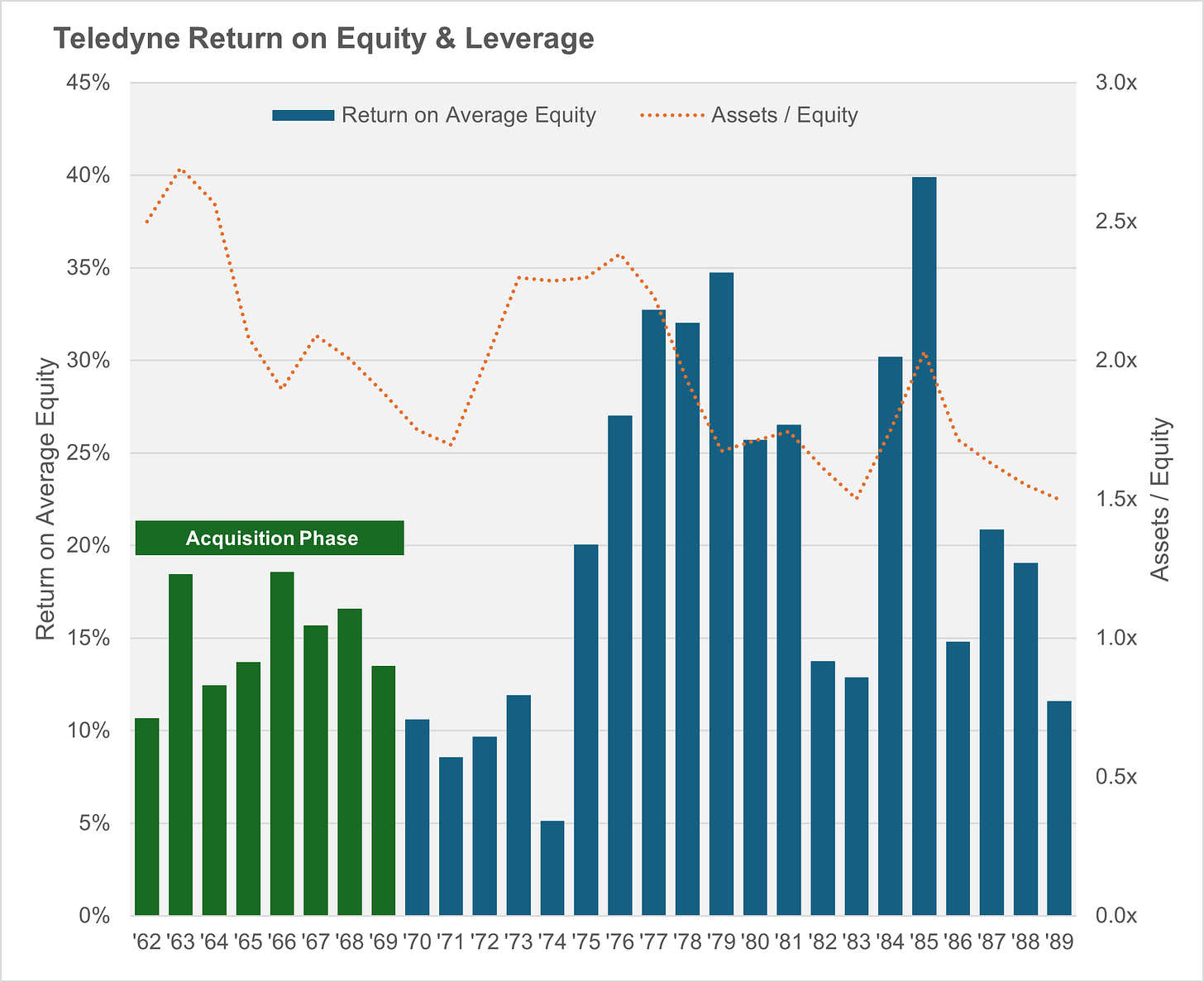

EBIT Margin - Teledyne President, George Roberts, wrote in the book “Distant Force” that once the Teledyne “acquisition machine” stopped in 1969, they focused on improving operations/margins. He mentions that in 1975, Teledyne began focusing on increasing sales of higher margin product lines and de-emphasizing lower margin lines. This resulted in gross margins increasing by roughly +400bps in ‘75. This trend continued throughout ‘76-’77, with gross margin ultimately expanding from 19% to 26% from 1974-1977. Much of the gross margin increase fell to the bottom-line, with EBIT margins expanding by +~700bps over that timeframe, from 7% to 14%.

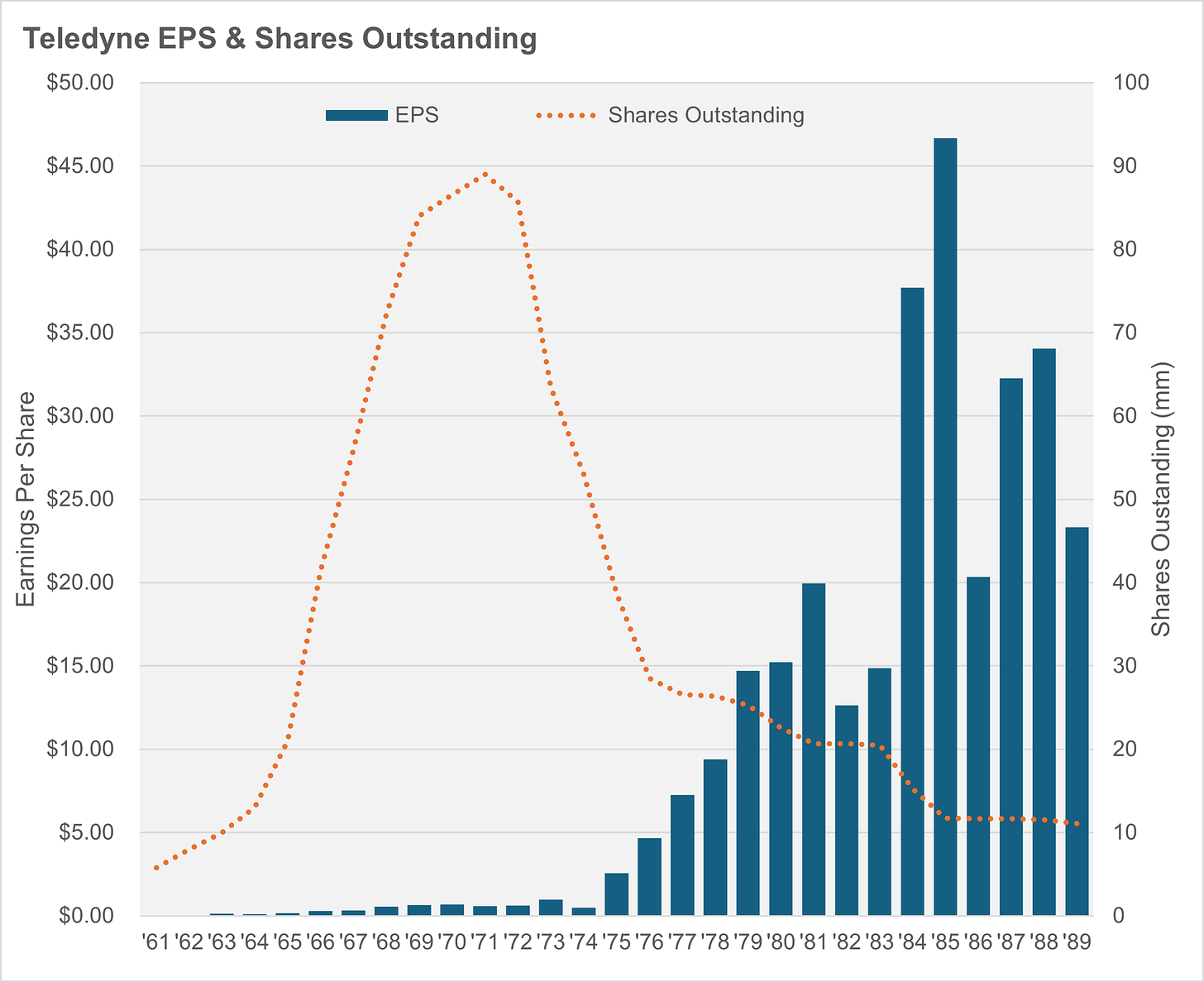

Teledyne EPS & Shares Outstanding (two charts) - The outstanding capital deployment record that Buffett talks about can be summarized in the bottom two charts. High valued shares issued to acquire 130 companies in the 60’s and then repurchased ~90% of shares in the ‘70’s and ‘80’s. Also interesting to see the large EPS jump in 1975, which coincided with the increase in margins. Improved operations combined with 50%+ less shares outstanding caused earnings per share to explode higher.

Sources:

Article - Forbes 1978 - "The Sphinx Speaks"

Presentation - "A Case Study in Financial Brilliance" by Leon Cooperman

Book - Distant Force: A Memoir of the Teledyne Corporation and the Man Who Created It

Book - The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success

Underlying data source for financial figures - https://www.turtlebay.io/financials

Disclosure: Nothing said in this article is investment advice. I may buy or sell shares in any company mentioned. Please do your own due diligence before making any investment. None of my posts are investment advice. For full disclaimer, please click here.

Buffett was a fan of Henry Singleton. He’s been doing the same at Berkshire with buybacks. I need to read that book. I had a friend who sadly passed away last year that was a fan of Henry Singleton. Loved the Outsiders too. Everyone should read it. Thanks for the reminder. Take care and keep up the good work.